This past June I flew down to Miami to attend the annual Bitcoin Conference. Bitcoin 2021 was a symbolic and significant year for the event due to the fundamental truth about bitcoin: there are only 21 million and there will never be more. This Austrian economic framework creates a valuable digital asset based on scarcity. Bitcoin is not like gold, silver, or other precious metals which can be mined from the earth each year. Bitcoin is not like government fiat currencies, which can be created in surplus by a central bank. Bitcoin is finite and absolute.

Toward the end of the second day of the conference, Jack Mallers, the 27 year old CEO of Strike, a payments company that allows users to be paid in bitcoin, made a much anticipated announcement. He had met with the president of El Salvador, a nation whose currency had been debased, whose people had to rely on crime and gang related activity to make a decent living, whose corrupt institutions stole money from family members sending USD and other more stable currencies back into the region. The President of El Salvador had agreed to make bitcoin legal tender. It was the first country to do so. This announcement was met with a kind of blind euphoria. The attendees erupted with celebratory high fives and hugs, as this had apparently been a goal of the bitcoin community for over a decade.

I refreshed the price only to see that bitcoin was still down about 50% from its high of $65,000. The price barely moved on this news, and I failed to see what the significance of a country like El Salvador making Bitcoin legal tender would have. The comedian Tim Dillon, who spoke after, joked that if “You do not own bitcoin in El Salvador you will be shot on spot, and that is a good thing.”

On Tuesday, September 7th, this law went into effect in El Salvador, and every vendor, from Starbucks and Macdonalds to each Mom & Pop bodega were legally required to accept bitcoin as payment.

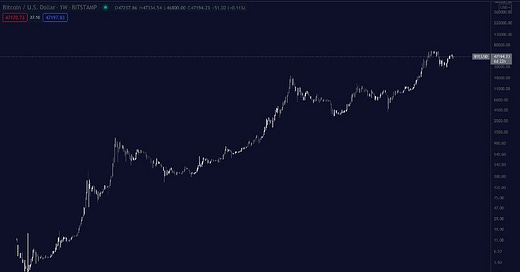

In typical bitcoin fashion, the price dropped over 20% that day from $53,000 to $43,000, quickly stabilizing around $47K. Naysayers and pundits were commenting on how El Salvador had just had a rude awakening to the horrific volatile qualities of bitcoin. The truth is that if you zoom out and look at bitcoin over the past decade, there is no denying the volatility, but that volatility has swung violently towards the upside. It is the fastest asset to go from 0 to $1 trillion dollars (12 years) in history and is showing no sign of slowing down. Bitcoin is an exponentially growing monetary network.

What is significant about El Salvador making bitcoin legal tender is that transnational corporations who continue to operate in El Salvador are forced to keep bitcoin on their balance sheet. If bitcoin continues the cyclical pattern it has followed each year following the halving, there is about to be a parabolic rise in the price over the next 6 months. Macdonalds and Starbucks executives are going to experience first hand what Bitcoiners have over the past decade; an explosive rise in price. I believe this will incentivize the companies to begin accepting bitcoin at other locations in other countries.

Technology tends to make things cheaper over time. The smart phone has essentially made taking photos and videos free. Spotify has collapsed the price of listening to music, and Netflix has done the same to watching cinematic content. The irony of our time is that central banks and governments are determined to achieve 2% inflation each year, which can only be done by creating a surplus of monetary supply. The natural forces of technology are deflationary, and this applies to every industry, from banking and real estate to agriculture. As a currency, bitcoin has the opposite effect. As the price of bitcoin rises, the cost of goods in relation to it fall. The price of bitcoin will inflate in relative terms to dollars and other currencies, but as the price of bitcoin goes up, holders of the asset will find goods and services to be cheaper. It has the opposite effect of government backed and issued money. There is a finite amount of bitcoin and no central power can ever create or issue more of it.

On Monday, September 6th, El Salvador announced that they had acquired roughly $21 million of bitcoin, putting the asset on the country’s balance sheet. They now (9/20/2021) own 700 bitcoin. On a global scale, El Salvador may seem like an insignificant crime ridden country, unlikely to cause a windfall of followers. One could say the same thing about Michael Saylor, the eccentric CEO of MicroStrategy, who was the first publicly traded company to announce last August that he had put bitcoin on the company’s balance sheet. He then shared a road map for others to follow and in the coming year insurance conglomerate MassMutual, payments company Square, Tesla and many others made similar announcements in regards to bitcoin.

El Salvador is the first country to realize that their citizens cannot be saved by the current system in place, which only benefits asset holders and qualified creditors of the nations currency. Hyperinflation is an economic disaster which occurs when a currency loses 50% of its purchasing power month after moth. There have been 57 cases over history, most recently in Venezuela. Us in the West, especially in America, take stable governments, stable currencies and peaceful social interactions for granted, although even that is changing. In Latin American countries, where corruption is more rampant, savers of the nations currency often face disastrous outcomes as incomes and savings cannot keep up with the rising price of goods. Due to this poor monetary policy, citizens often must resort to crime and gang related activity just to make ends meet.

Bitcoin is a technology that will continue to disrupt centrally controlled government currencies. Since it is decentralized money, even if one nation bans the asset, the network will continue to exist and thrive elsewhere. We saw this happen this year when China decided to ban mining bitcoin, the mining companies quickly migrated elsewhere.

With all this said, the US Dollar will likely continue to be the world reserve currency, as it is a trusted unit of exchange globally. Many weaker fiat currencies will continue to get devalued and citizens of poorer nations will turn to a solution that is enriching rather than enslaving. El Salvador is the first, and due to the network of transnational corporations who will see the benefit of accepting bitcoin, the neighboring countries who have similar issues, and the will of the Latin American people, many countries will follow in the coming 12-36 months. Gradually, then suddenly.

Buying Bitcoin is a unique asymmetric investment opportunity for average people to forerun and outperform major corporations, institutions and nation-states. Bold and innovative risk takers will be the beneficiaries in the coming decade. Bitcoin is inevitable. Most just haven’t realized it yet.

If you enjoyed this piece please subscribe to my Substack for new articles each Monday and Friday. I am dedicated to making myself and my community stronger, smarter and richer.

[This essay is speculative and not financial or legal advice.]